SBF’s ex-girlfriend Caroline Ellison pleads guilty to fraud charges

Published on Dec 22, 2022 at 7:26 PM (UTC+4)

by Alessandro Renesis

Last updated on Dec 23, 2022 at 3:02 PM (UTC+4)

Edited by

Kate Bain

Former crypto billionaire Sam Bankman-Fried has just been released on $250 million bond after being extradited to the US.

In the meantime, his ex-girlfriend Caroline Ellison has pleaded guilty to fraud charges after being arrested in NYC.

Now the question on everyone’s mind is: will she turn on him?

READ MORE: From Eminem and Snoop Dogg to Elon Musk, these celebs still have millions in crypto

Ellison was romantically involved with SBF, but she was also the CEO of Alameda Research, a trading firm that used FTX as its piggy bank under SBF’s watch.

FTX co-founder Gary Wang was also arrested and he too, like Ellison, has pleaded guilty.

They will undoubtedly be asked to testify against SBF to have their respective sentences reduced.

CHECK THIS OUT!

Honestly, there’s so much going on here that even Hollywood screenwriters couldn’t come up with a better storyline.

As you can imagine, the internet is going crazy.

Coffeezilla, a YouTuber who uncovers crypto fraud, wrote on Twitter: “SBF’s partners… found a way to screw him one last time.”

Referring to a photo of SBF’s ex-girlfriend, another commentator said “the face you make when you cut a deal to save yourself an extra 60 years in jail by sinking your ex lover”.

Timeline of the FTX collapse

Nov 6: FTX rival Binance says it wants to liquidate its entire position in FTX.

Nov 7: SBF tweets “FTX is fine. Assets are fine”. He deletes the tweet hours later.

Nov 9: Binance says it won’t bail out FTX after ‘due diligence’ as US regulators begin investigating FTX.

Nov 11: FTX files for bankruptcy, SBF is replaced by insolvecy specialist John Ray III as CEO.

Nov 12: Customers funds go missing in an alleged hack.

Dec 12: SBF is arrested in the Bahamas.

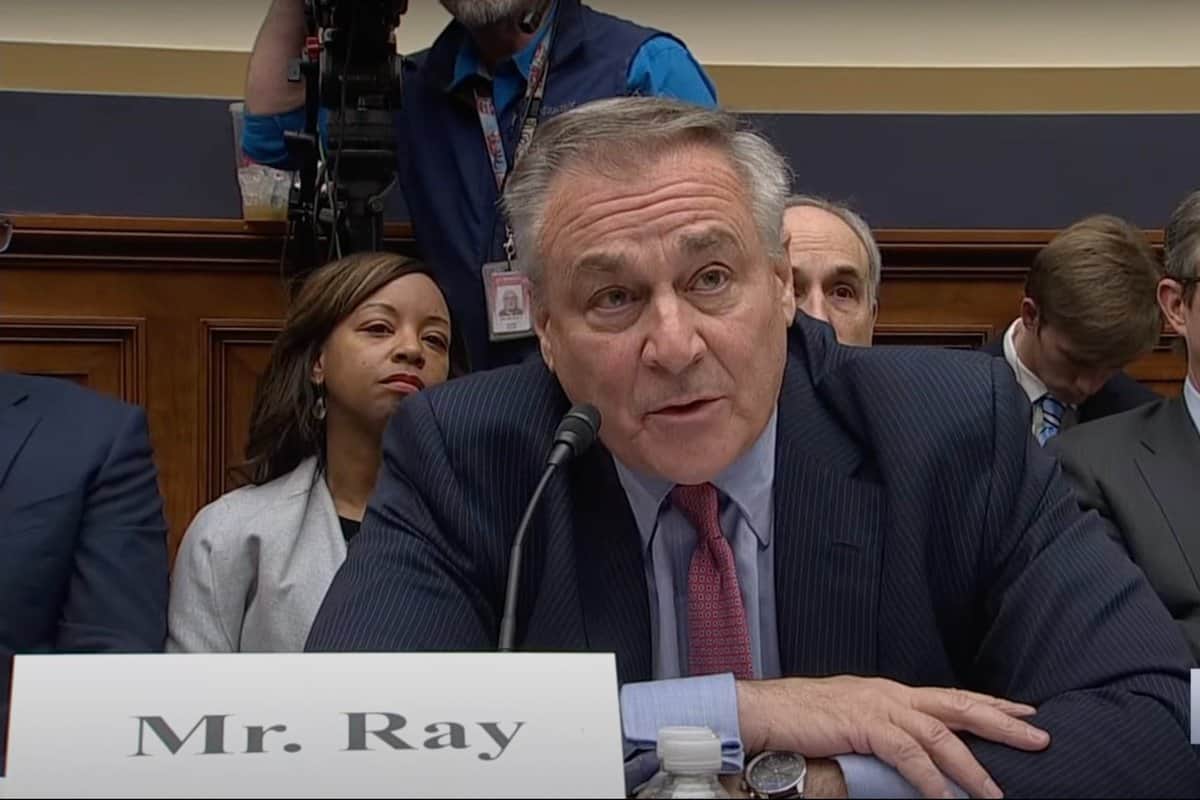

Dec 13: John Ray testifies before the US House Committee, says FTX is one of the worst business failures he’s seen.

Dec 22: SBF is released on a $250 million bond and will live with his parents awaiting trial.

John Ray III on FTX and SBF

John Ray III is a court-appointed insolvecy attorney that specializes in bankruptcy proceedings.

In his testimony about the FTX collapse, Ray said he’d “never seen such a complete failure of corporate controls”.

He added that he found no evidence of the hack as claimed by SBF, and that at least $3 billion was taken out of Alameda by SBF for personal use.

On at least two occasions, Ray said he found SBF was both the borrower and the lender of funds.

You can watch the full testimony in the video below.

DISCOVER SBX CARS: The global premium car auction platform powered by Supercar Blondie